Minimalism, Money, and the Freedom Dividend

- House of Realtors Content Creation Team

- 3 days ago

- 3 min read

Adapted from commentary by Rob Hersov, with additional context and local perspective for the Haasendal Estate audience.

There’s a word that gets misunderstood far too easily: minimalism. People hear it and picture empty rooms and self-denial. But real minimalism is simpler than that—it’s the deliberate removal of clutter (especially possessions) so you can gain clarity of mind, clarity of purpose, and a deeper sense of calm.

In a world obsessed with accumulation, Rob Hersov argues for a different approach: focus on what actually moves the needle in your life. For him and his wife, that means prioritising family first—then putting attention into just a few high-impact areas: financial reserves (he often references Bitcoin), property, and great experiences.

Everything else? Often just noise.

The trap of “prestige anxiety”

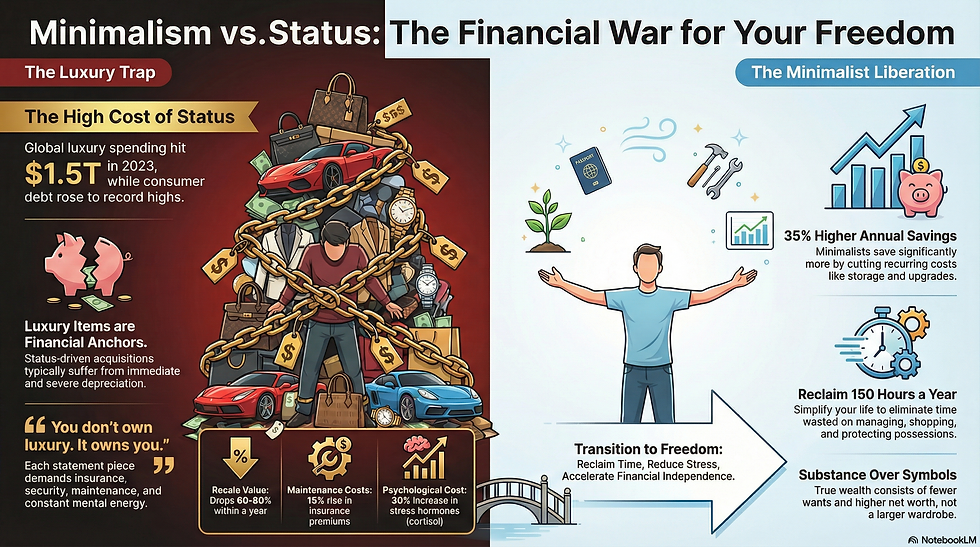

We’re surrounded by subtle pressure to “look successful.” The problem is that status is expensive—and it rarely pays you back.

Consider the bigger picture: the overall luxury market was estimated at around €1.5 trillion in 2023, reaching a new record. (Bain) Meanwhile, household balance sheets in many places have been under strain—US household debt and credit card balances have repeatedly set new highs in recent years, according to the Federal Reserve Bank of New York’s tracking. (Federal Reserve Bank of New York)

Closer to home, South African household debt has hovered in the low-60s as a percentage of disposable income in recent quarters—an important reminder that “more stuff” is often financed, not earned. (South African Reserve Bank)

That’s the heart of the warning: luxury doesn’t necessarily elevate you—it can anchor you.

Because luxury items don’t just cost money once. They usually demand ongoing “mental rent”:

insurance and security

maintenance and storage

admin and worry

constant upgrading to keep up

At some point, you don’t own the lifestyle—the lifestyle owns you.

Real wealth vs. depreciating assets

Here’s a practical way to see it, borrowing from business thinking:

If your personal life were a company, many status purchases would be the loss-making divisions. They drain cash flow, add complexity, and quietly steal focus.

In contrast, fewer possessions often create:

lower monthly overhead

more investing power

more mobility and flexibility

less stress and decision-fatigue

Minimalism isn’t deprivation. It’s a strategy to redirect resources away from ego and into freedom.

Why property and experiences win

One of the strongest points in Rob Hersov’s story is how lifestyle changes force clarity: when you move, downscale, or simplify, you quickly discover how much you own that doesn’t actually improve your life.

And once the excess is gone, what remains becomes obvious:

a well-chosen home (or portfolio of property)

cash reserves

memorable experiences—the “memories for the rocking chair”

That’s a powerful framework for anyone trying to build real wealth: spend less on symbols, and more on assets and life.

A CFO-style audit you can do this week

Try this simple filter the next time you’re tempted by a flashy purchase:

Does it appreciate, produce income, or meaningfully improve daily life?

What will it cost me after I buy it (time, maintenance, insurance, stress)?

Am I buying utility… or am I renting confidence?

When you stop outsourcing your self-worth to brands, you get something better in return: cash flow, time, and peace of mind.

Bringing it home

Minimalism pairs naturally with smart property decisions—especially when you choose a home that supports a simpler, more intentional lifestyle: secure living, lock-up-and-go convenience, and spaces designed for living well rather than showing off.

So if you take one takeaway from Rob Hersov’s philosophy, let it be this:

Sell the status symbols. Buy freedom. Invest in assets and experiences.Because freedom will always look better than diamonds ever will.

Attribution note: This article is a rewritten, locally adapted interpretation of themes Rob Hersov has discussed publicly; any errors in interpretation are ours. Key market figures referenced are supported by Bain & Company / Fondazione Altagamma and the South African Reserve Bank publications. (Bain)

Comments